Indicators on P3 Accounting Llc You Should Know

Wiki Article

P3 Accounting Llc - Truths

Table of ContentsThe 7-Minute Rule for P3 Accounting LlcFacts About P3 Accounting Llc UncoveredThe Facts About P3 Accounting Llc RevealedWhat Does P3 Accounting Llc Do?The Of P3 Accounting Llc

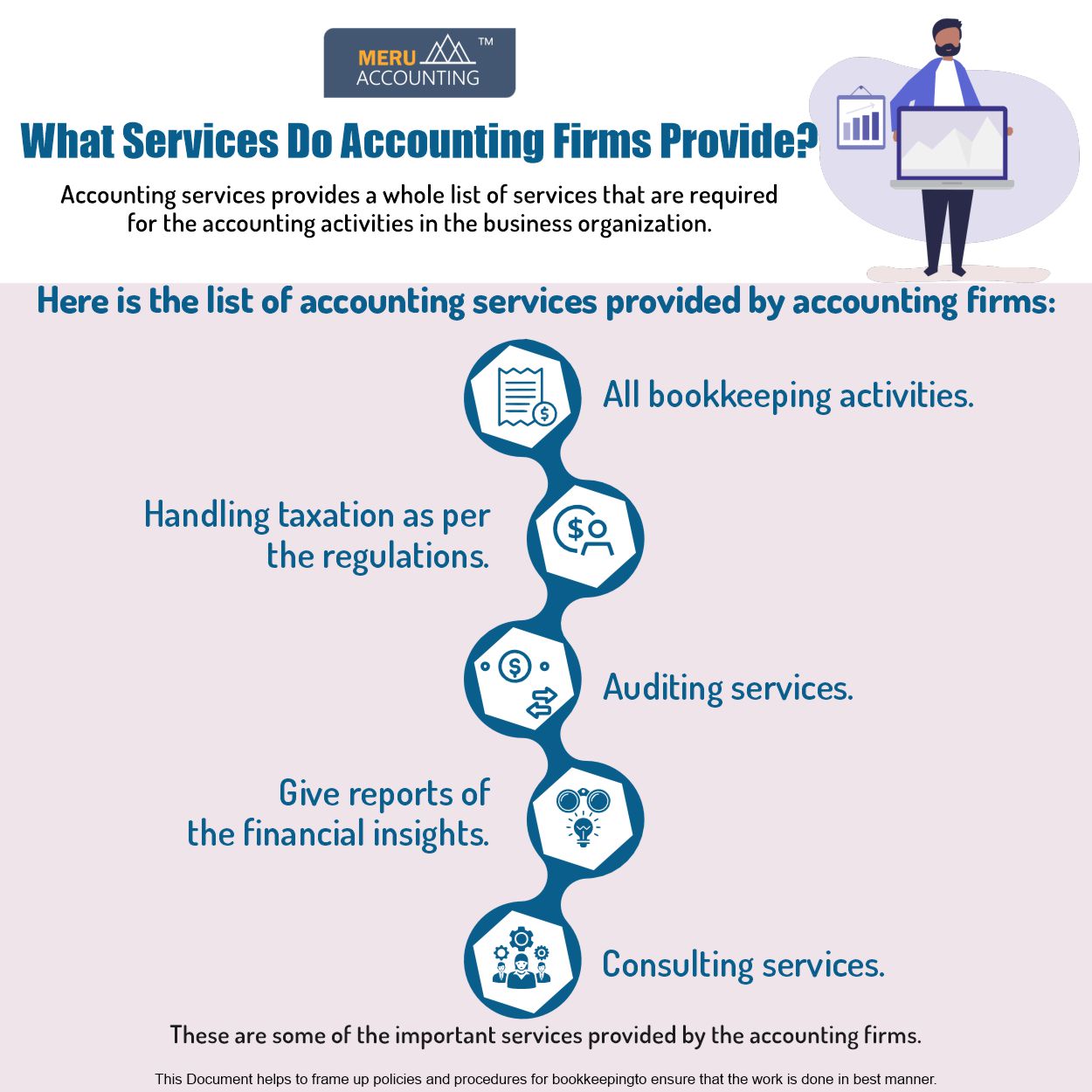

When individuals assume of the accounting field, normally tax obligations enter your mind (taxes OKC). And while a great deal of certified public accountant's and accounting professionals do operate in tax obligation preparation or with income tax return, did you recognize there are numerous various other sorts of accounting companies in the market? Bookkeeping involves a whole lot even more than just taxesJust like the name suggests, an accountancy firm is a team of accountancy experts that supply tax resolution, accounting, auditing and advisory solutions (plus a variety of various other services) to paying customers. https://www.provenexpert.com/p3-accounting-llc/. Certified public accountant's, or licensed accountants, can operate at firms like these but not every accountant is a certified public accountant yet every certified public accountant is an accounting professional

CPA's need to stay on par with CPE (continuing expert education) credit reports also to maintain their license. There are different sorts of audit firms, including: Public Private Federal Government 1. Full-Service Audit Firms Typically, a full-service audit company supplies a wide range of services from tax obligations to consultatory to audits, and much more.

How P3 Accounting Llc can Save You Time, Stress, and Money.

These techniques have the sources required to use a full collection of solutions, thus the name full-service. 2. Tax Companies Tax Firms are a specialized type of accounting companies which focus virtually exclusively on tax obligation preparation, planning and resolution for businesses and people. Accountants operating at these companies are usually Certified public accountants and it's vital for them to remain up-to-date on tax regulations.Bookkeeping Firms Bookkeeping firms are concentrated on record-keeping and maintaining track of earnings, costs, payroll and for some, tax obligation returns for service customers. Which kind of audit company do you function at?

Some Known Facts About P3 Accounting Llc.

It is essential to have an accurate and reputable accountancy and monetary coverage procedure to help you. The advancement of an effective services version called customer audit solutions supplies automated modern technology and economical accounting guidance to help your business expand.Under CAS, find a remote group of specialists (from a company that uses CAS) functions as an indispensable component of your company and has a deeper understanding of your organization. Companies use client bookkeeping solutions in numerous selections based upon your service requirements. Some manage just transactional solutions, while others aid you with all your audit needs, including transactional, compliance, performance, and tactical services.

Right here are a few of them. While the majority of service owners recognize the demand for a skilled accounting specialist on their group, the expense of hiring a full-time employee for economic coverage may not be feasible for every person. When you employ an employee, you are not only paying wage and advantages like medical insurance, retirement, and paid-off time however are additionally taking care of FICA, unemployment, and other tax obligations.

The smart Trick of P3 Accounting Llc That Nobody is Talking About

As your service expands and your financial requirements change, an expert customer accounting providers will alter their services to meet your service needs and supply far better versatility. Need to read You may make most business decisions based upon standard monitorings and impulse, however having numbers on your side is a terrific way to back up your resolutions.

CAS accountants comprehend your firm throughout. https://triberr.com/p3accounting. They can additionally offer an individualistic point of view on accounting methods and development barriers and assist you make informed decisions to conquer them. One of the benefits of collaborating with a firm that uses customer bookkeeping solutions is access to the most recent bookkeeping software program, automation methods, and modern technology changes that can boost your service

Examine This Report on P3 Accounting Llc

The team you function with might be software application professionals efficient in advanced software program features like Intuit Quick, Books, Microsoft Dynamics 365, Sage, or Web, Suite. Or, they might be generalists that can carry out standard bookkeeping jobs on any kind of software. Accountancy and bookkeeping can hinder your interest from what's more vital to your company, particularly if it is not your mug of tea.A study conducted among 1,700 business that contract out bookkeeping showed that CAS conserves time on total organization operations. With the best individuals, systems, and procedures available, you can enhance resources, optimize earnings, take care of financial investments, and produce company expansion versions as effectively and quickly as feasible. Need to review Unfortunately, fraudulence is among the inevitable occurrences every business faces.

Report this wiki page